The CIBIL API by Verifyal is a secure, real-time interface that allows individuals and businesses to access official credit reports and scores from TransUnion CIBIL, India’s most trusted credit bureau. It simplifies credit data retrieval for use in lending, underwriting, and credit analysis.

CIBIL Credit Report API by Verifyal

Verifyal’s CIBIL Credit Report API offers a fast, secure, and automated way to access official CIBIL credit reports and scores. This powerful tool connects directly with TransUnion CIBIL, India’s leading credit information bureau, which tracks and maintains credit data for individuals and businesses.

With this API, you can instantly retrieve verified credit insights used by banks, NBFCs, and financial institutions to assess creditworthiness, manage risk, and speed up approval processes.

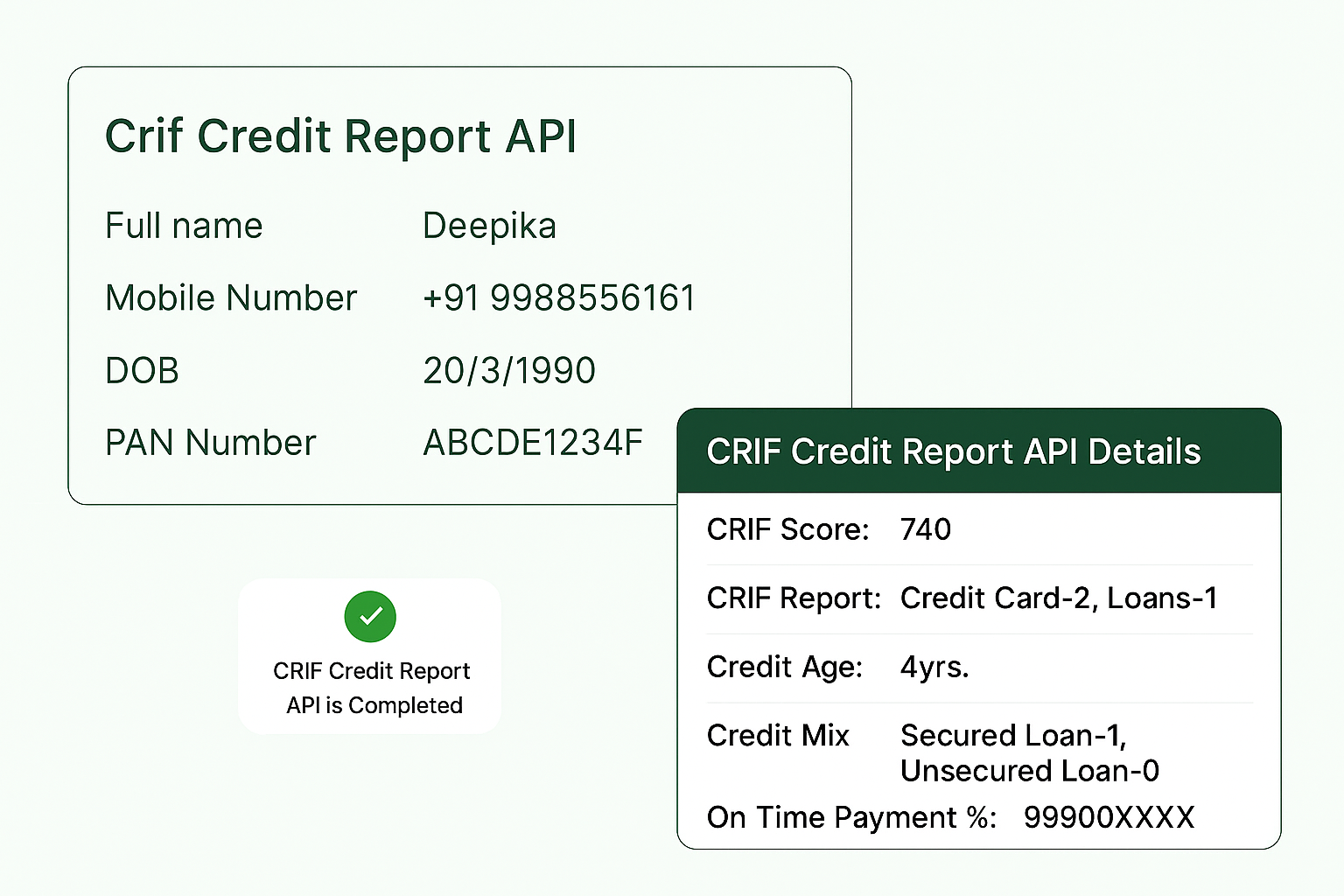

What You Need to Provide: Full Name, Mobile Number, Date of Birth, PAN Card Number, Using these details, the API returns the user’s CIBIL credit score, along with a full credit report, including repayment history, credit age, credit utilization, and inquiry data — all in a structured, developer-friendly JSON format.

Get Started

AUG

97%

Success Ratio