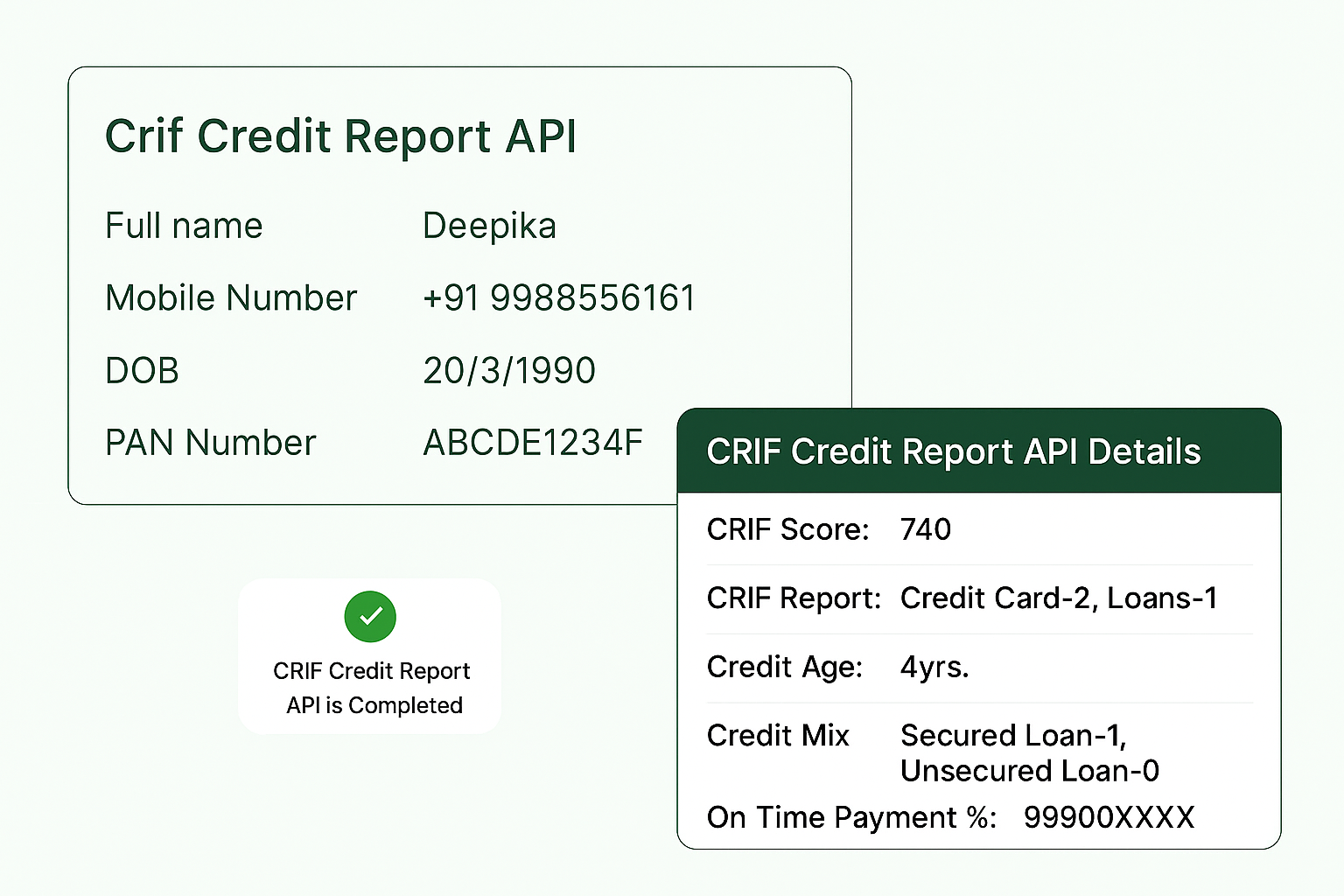

It’s a single API solution that allows businesses to fetch credit scores and detailed credit reports from multiple Indian credit bureaus in one go.

Multi Bureau Pull API by Verifyal

Verifyal’s Multi Bureau Pull API enables businesses to instantly fetch credit scores and detailed reports from all major credit bureaus in India — including CIBIL (TransUnion), Experian, CRIF High Mark, and Equifax.

This powerful API delivers comprehensive credit data within seconds, making it the ideal solution for lending institutions, fintech platforms, and NBFCs to assess borrower creditworthiness quickly and accurately during loan approvals.

Get Started

AUG

97%

Success Ratio