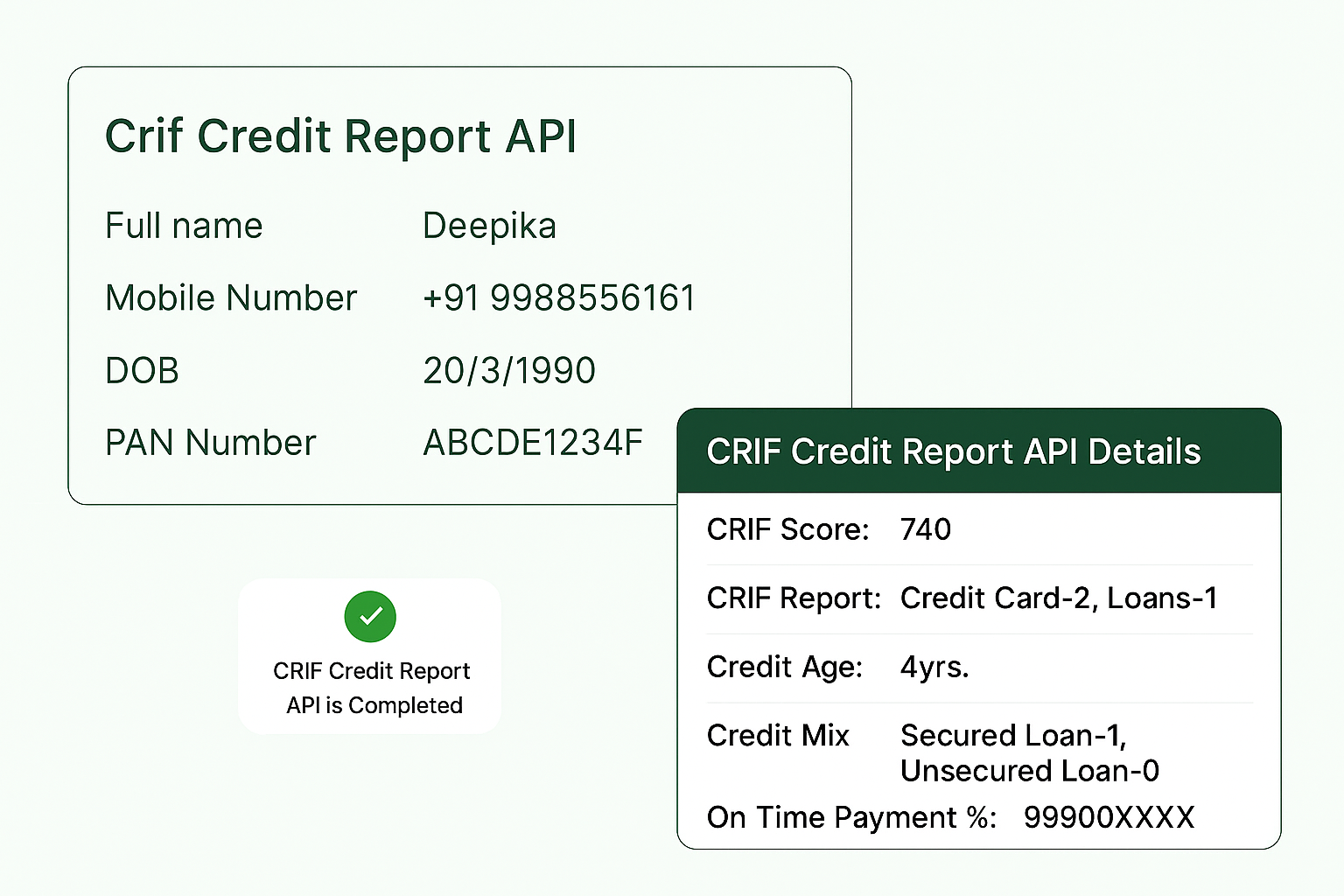

It provides access to a person’s complete credit history, including their CRIF score, credit accounts, repayment patterns, and current liabilities — all through a simple API call.

Crif Credit Report API by Verifyal

Verifyal proudly offers the newly launched Crif Credit Report API — your all-in-one solution to instantly access accurate credit information.

Powered by CRIF High Mark, one of India’s leading credit information bureaus, this API allows you to fetch real-time credit reports and CRIF credit scores using just basic details like: Full Name Mobile Number Date of Birth PAN Card Number

Seamlessly integrate this API into your application or platform to streamline credit checks, enhance decision-making, and reduce risk.

Get Started

AUG

97%

Success Ratio