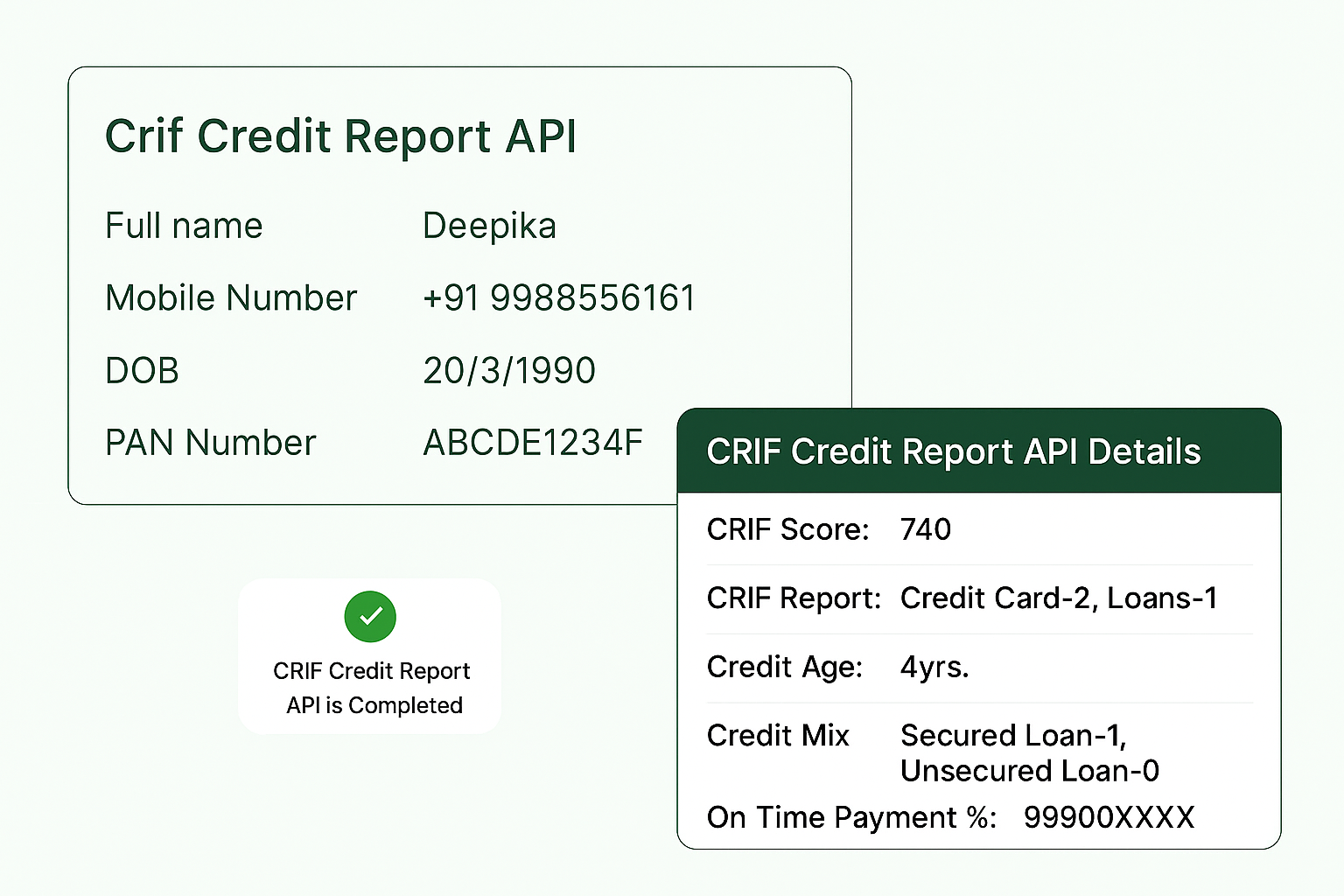

To access an Experian credit report via the API, users must provide: Full Legal Name, Mobile Number (linked to the credit profile), Date of Birth, PAN Card Number, These details are used to securely authenticate and retrieve the correct credit profile.

Experian Credit Report API by Verifyal

Verifyal’s Experian Credit Report API offers fast and secure access to detailed credit reports and scores from Experian, one of India’s leading credit bureaus.

This powerful API streamlines the credit-checking process and delivers valuable financial insights in real time — ideal for banks, NBFCs, fintechs, and other credit-driven platforms.

How It Works: Provide the following user details: Full Name, Mobile Number, Date of Birth, PAN Card Number, With this information, the API fetches: Experian Credit Score Full Credit Report (JSON + PDF) Key financial indicators like payment history, credit age, and inquiries

Whether for loan underwriting, credit card issuance, or risk analysis, Verifyal’s Experian API ensures accurate and actionable credit insights within seconds

Get Started

AUG

97%

Success Ratio