It’s an API service that allows you to access a user’s TransUnion CIBIL credit report and score instantly using basic identity details. It’s designed for fast, reliable, and secure credit verification.

TransUnion Credit Report API by Verifyal

Verifyal introduces the powerful TransUnion Credit Report API, designed to help businesses access accurate and real-time credit information with ease.

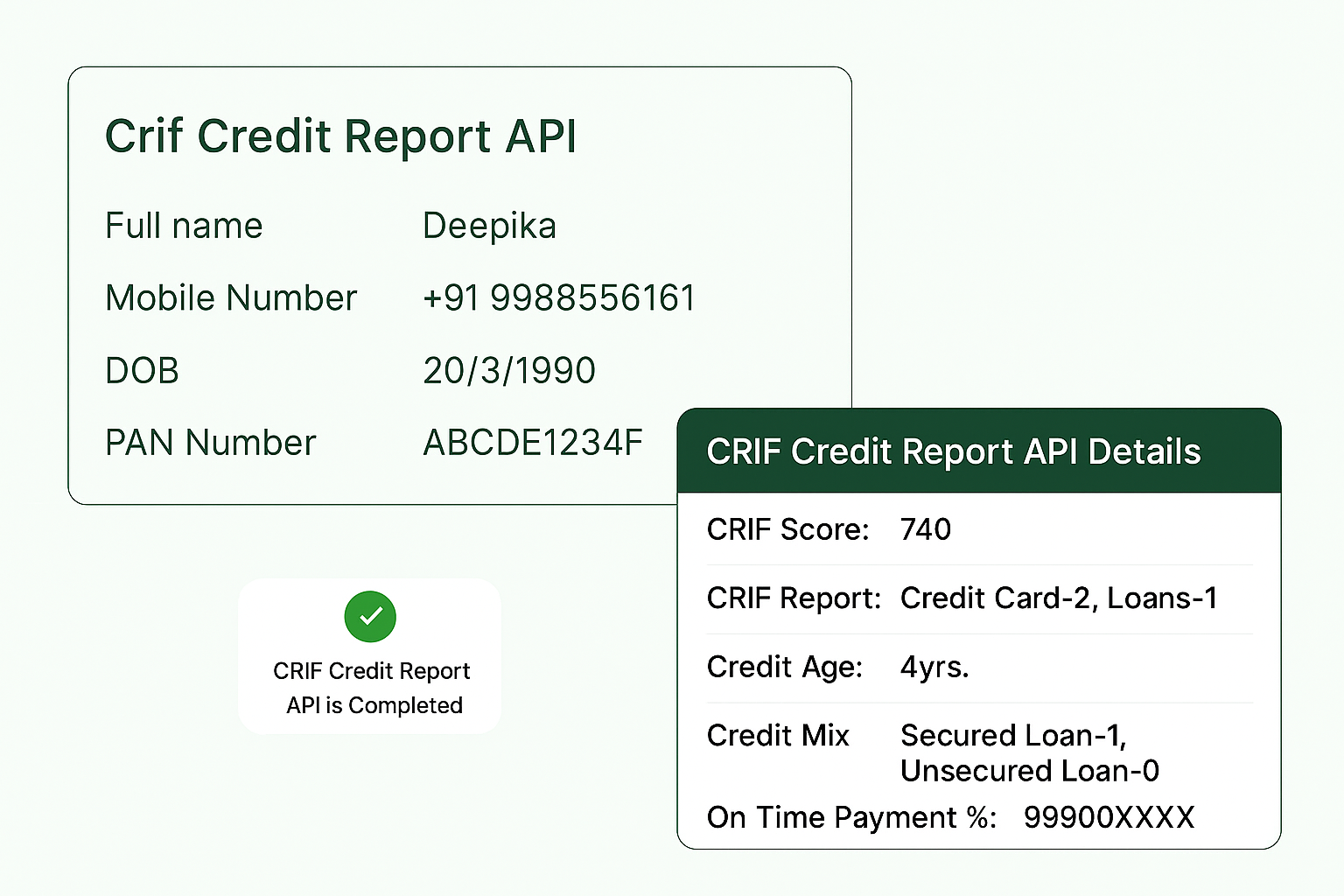

Developed in collaboration with TransUnion CIBIL, one of India’s leading credit bureaus, this API allows you to instantly retrieve a customer’s TransUnion credit score and detailed credit report using just four key details: Full Name, Mobile Number, Date of Birth, PAN Card Number

Whether you're a fintech company, NBFC, bank, or any business performing credit checks, this API enables seamless integration, helping you make faster, smarter, and safer lending or onboarding decisions.

Get Started

AUG

97%

Success Ratio