A Credit Score Check API is a digital tool that enables businesses to access a person’s credit score in real time by integrating directly with regulated credit bureaus. It helps lenders and financial institutions assess the creditworthiness of borrowers instantly and accurately.

Credit Score Check API by Verifyal

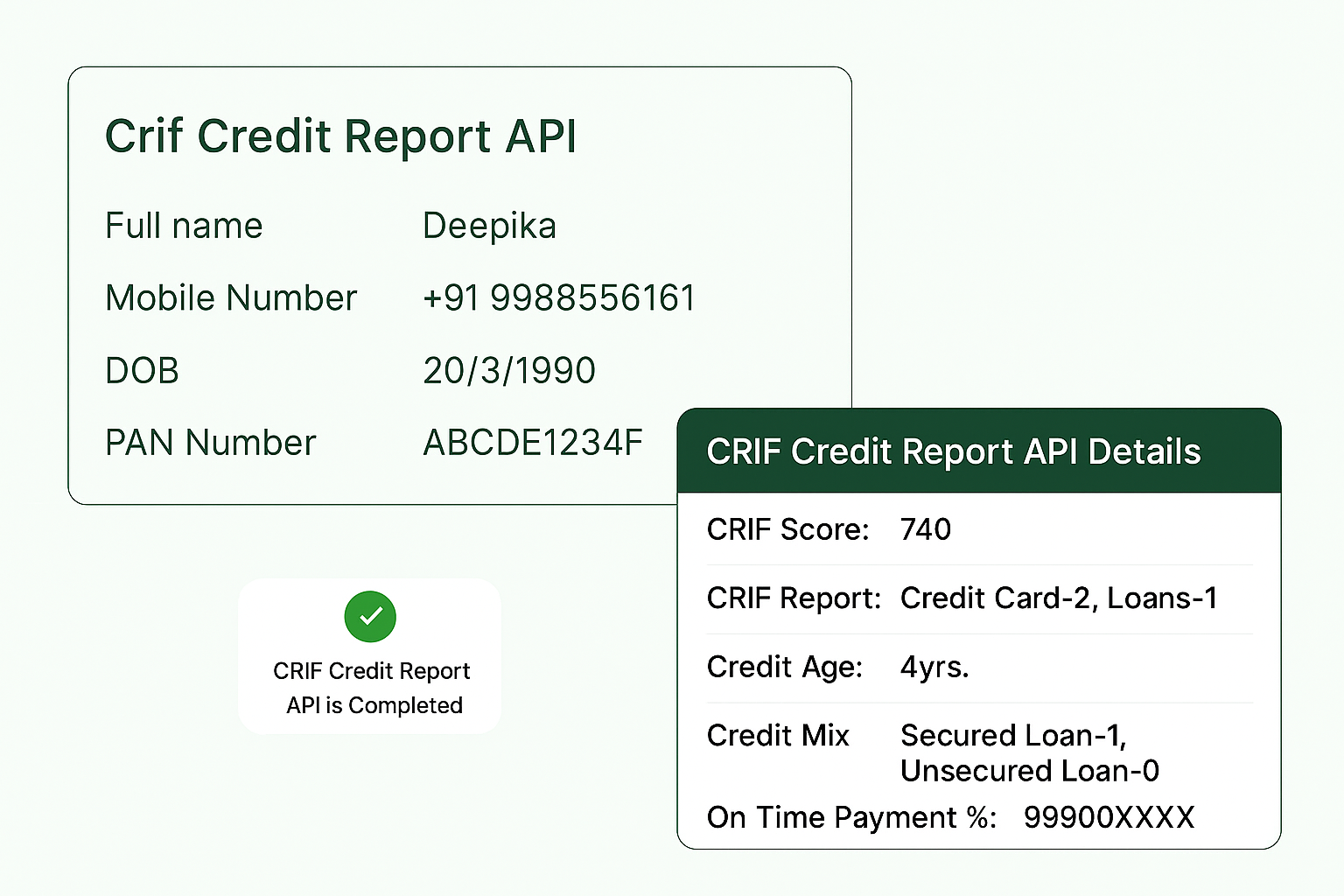

Verifyal’s Credit Score Check API is your go-to solution for quickly accessing an individual’s real-time credit score in just a few seconds.

Simply enter the user’s Full Name, PAN Number, and Mobile Number, and the API will instantly retrieve their verified credit score from trusted credit bureau databases.

Perfect for lenders, fintech platforms, and financial service providers, this API helps automate credit checks, reduce risk, and support faster financial decision-making.

Get Started

AUG

97%

Success Ratio